Retirement Planning Fundamentals Explained

Wiki Article

The 5-Minute Rule for Retirement Planning

Table of Contents10 Simple Techniques For Retirement PlanningThe 9-Minute Rule for Retirement PlanningSome Ideas on Retirement Planning You Need To KnowTop Guidelines Of Retirement PlanningRetirement Planning for Dummies10 Easy Facts About Retirement Planning Shown

A 401(k) match is also an extra cost-effective means to supply a monetary incentive to your staff members, as your company will certainly be paying less in pay-roll tax obligations than if you supplied a standard raising or benefit, as well as the worker will additionally obtain even more of the cash due to the fact that they will not have to pay extra income tax obligation - retirement planning.1. 5% might not seem like much, however just a rate of interest substances, so do costs. This cash is immediately deducted from your account, so you may not immediately see that you could be conserving hundreds of bucks by relocating your properties to a low-priced index fund, or changing providers to one with lower investment fees.

If you have specific retirement accounts where you can add with funds with tax obligations you've paid now vs. paying taxes upon the withdrawal of the funds in retirement, you may want to think about what would certainly conserve you a lot more in tax repayments over time. If you have specific shorter term financial investment accounts, believe regarding just how much money you 'd spend there (and also ultimately pay taxes on in the close to future) vs.

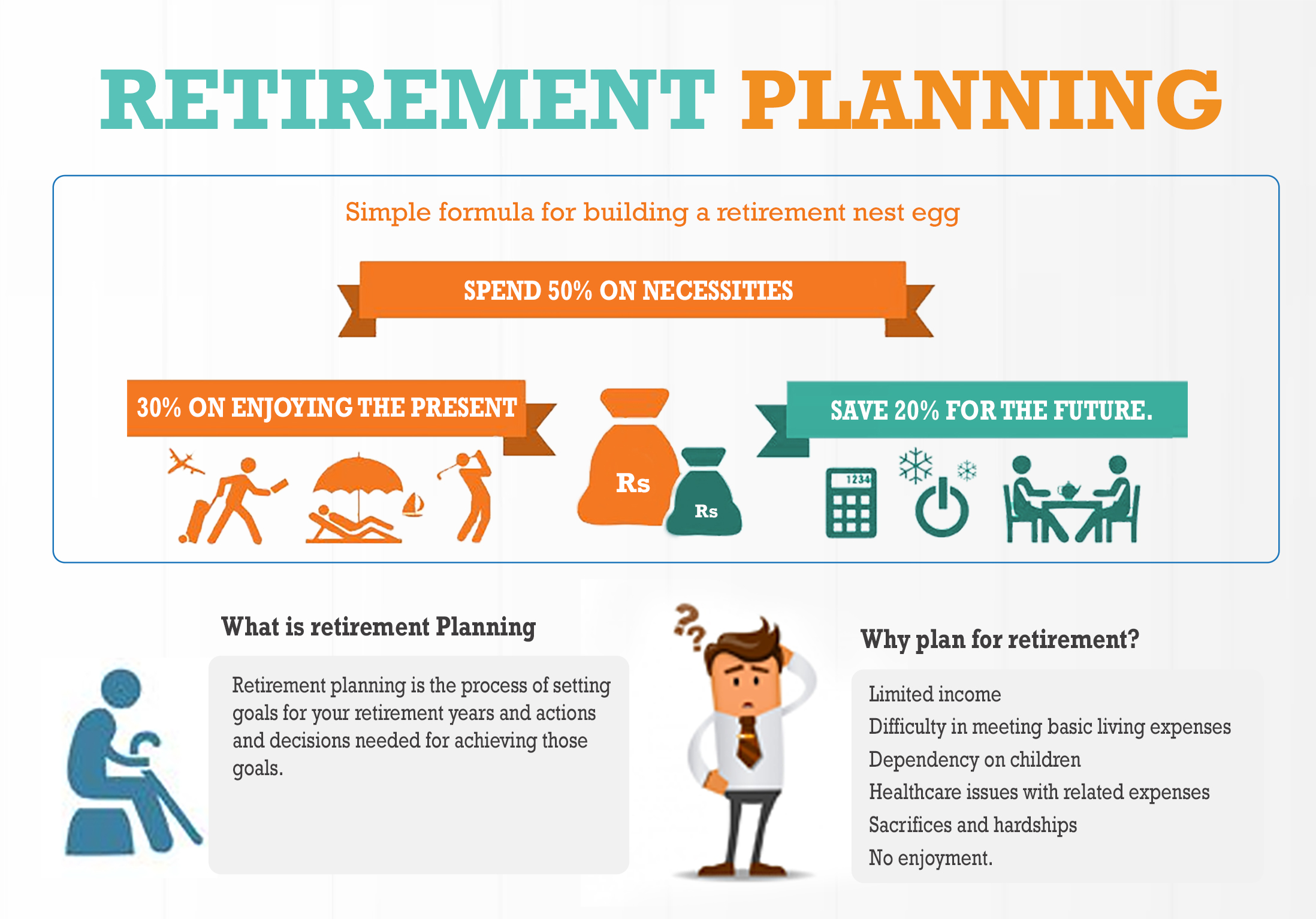

Listen to this: Before we start discussing begin talking about just how for intend successful retirementEffective retired life need to understand what comprehend retirement planning and why and also it important?

However, we think that rather than really feeling the pinch post-retirement, it's reasonable to begin saving early. What you just require to do is to start with an attainable conserving, plan your financial investments as well as with a long-lasting commitment. The method you want to invest your retired life totally rely on the amount of cash you have actually conserved and spent.

The smart Trick of Retirement Planning That Nobody is Talking About

Fulfilling their hefty medical costs and other needs along with personal family members requirement is really very challenging in today's age of high inflation. retirement planning. It is suggested to begin with your retired life financial savings as early as you are 20 years old and also single. The retired people present a significant burden on their family that had not intended and conserved for their retired life.There's always a wellness issue related to growing age. There might be a scenario where you can not work any longer and the cost savings for retired life will certainly assist to guarantee that you he has a good point are well cared of. The large question is that can you pay for the expense of long-lasting care considering that it can be really pricey and also is included in the cost of your retirement.

Do you want to maintain functioning after your retirement? The people that are unprepared for retired life usually have to keep working to accomplish their household's demand throughout life.

What Does Retirement Planning Do?

Nevertheless, if you begin late, it may happen that you need to give up or change yourself with your pre-retirement and retirement way of living. The quantity that you require to save as well as include each duration will depend upon just how very early you begin conserving. Starting with your retirement preparation in the twenties may appear as well very early for your retired life.

Starting early will permit you to create good retirement savings and also intending practices as well as offer you more time to remedy any kind of error and to determine any type of shortfall in accomplishing your goal - retirement planning.: Catch up on your Retirement Planning in your 50s The retirement ought to be created and executed as quickly as you begin working.

These financial organizers will certainly take into consideration different factors to do retirement analysis that includes your revenue, costs, age, desired retirement way of living and also so on. Therefore, utilize the sweat of your gold years to offer a shade in your old days to ensure that you leave the world with the feeling of complete satisfaction as well as completeness.

Retirement Planning for Beginners

There is a common misunderstanding amongst young employees, and also it frequently seems something like, "I have lots of time to prepare for retirement. If you wait for the "best" or "best" time, you'll never ever start.

The earlier you start, the much better. However, it's never also late to start. With these two principles in mind, employees can be motivated to plan for retired life promptly. Neither their age neither their current financial resources must can be found in the method of retired life preparation.

The 7-Minute Rule for Retirement Planning

Much of us put things off in some cases even the most productive people, obviously! However when it involves conserving for retired life, procrastinating is not encouraged. Early birds don't just get the worm - they obtain 5 star buffets i loved this for nearly no effort. Allow's highlight the cost of procrastination with a story of 3 imaginary couples.For instance, based upon data from the Office for National Statistics they had 6,444 of disposable revenue per head in 1977. In 1982, they had 7,435 of disposable earnings per head. By 1987, they had 8,565 These couples are just the same age The key distinction between them is, they really did not all start to save for their retired lives at specifically the exact same time.

They chose to save 175 each month (2,100 each year). It would certainly have stood for 16. 29 percent of their annual income. They acquired low-priced mutual funds, placing 70 percent of their money in supplies, 30 percent in bonds. The couple's funds matched the returns of each corresponding market. Simply put, as well as for this picture just, their securities market shared funds matched the S&P 500.

Report this wiki page